2018 Stock Market Jitters

Market Jitters have returned. It has been a long time since we have had a measurable pull back in the markets. This past week we have seen the market quickly pull back. This time is feeling a lot like 2015. For my clients that were with me then, this market pull back will likely feel familiar.

This post is going to be a review of the last pull back and what we wrote in 2015. I will be updating data and writing a similar article this time. The cliff notes version is that this pull back is most likely a pull back and not a recession. It is possible this time will lease to a recession, however, the “odds” are in the favor that it’s simply a pull back. At some point, we will have a pull back that turns into a recession but we are unlikely to know until after the fact.

Stock Market Pullback a Time to Reflect (Article from August 24, 2015)

This article had some key points.

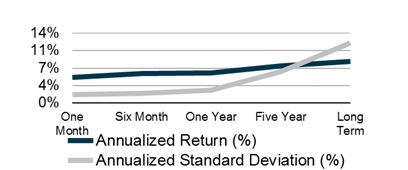

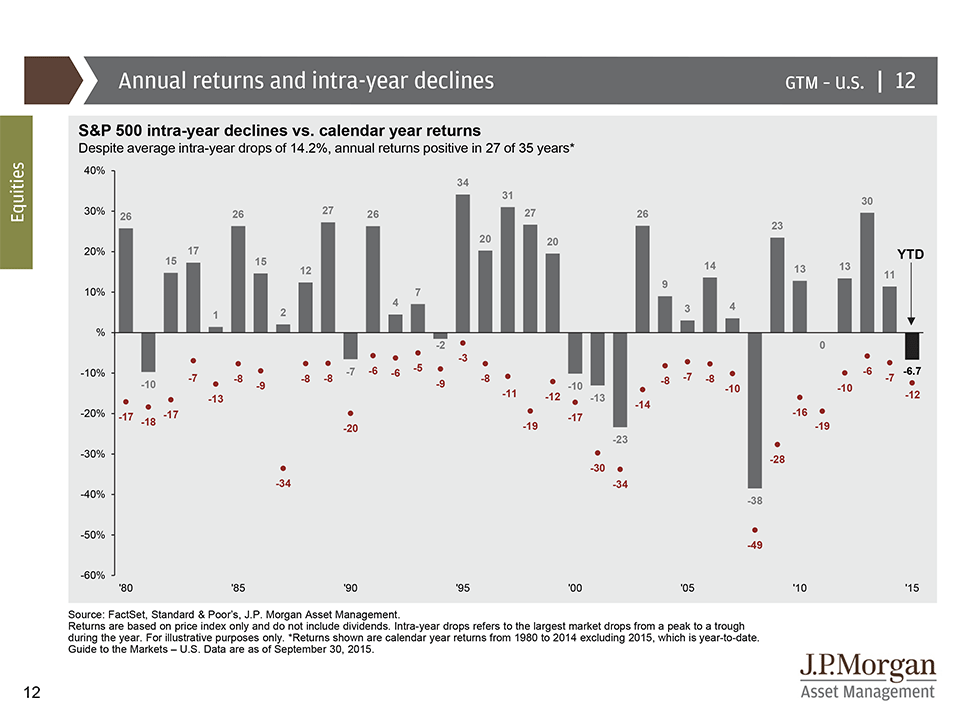

- The market pulls back on average 14% from the market high every year giving an investor a moment to panic or simply be reminded of the risk with investing. So a double digit pull back is not only normal but common.

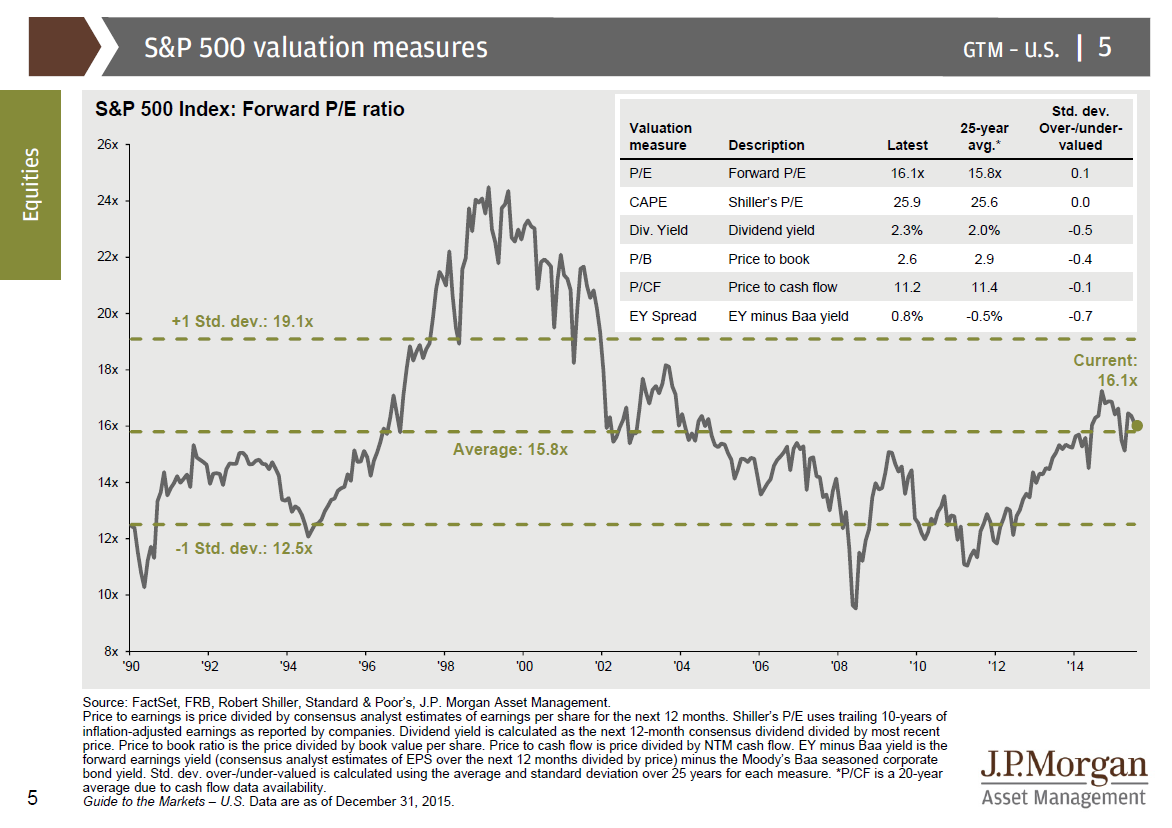

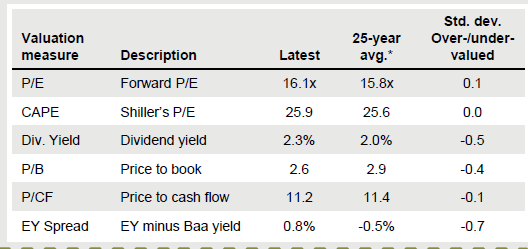

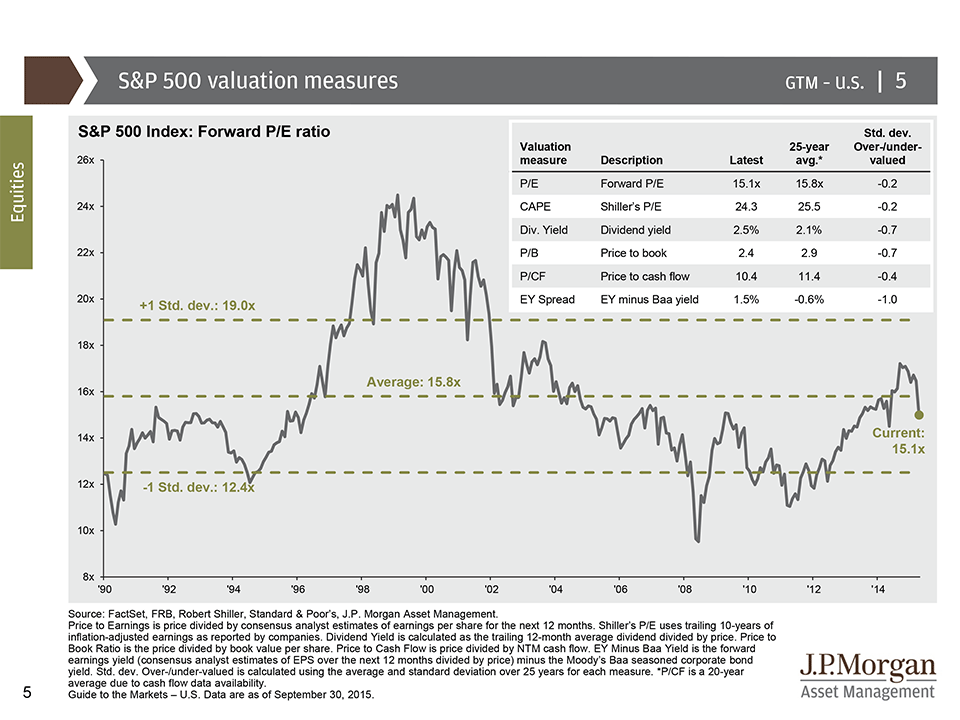

- Pull backs can happen even when markets appear fairly valued

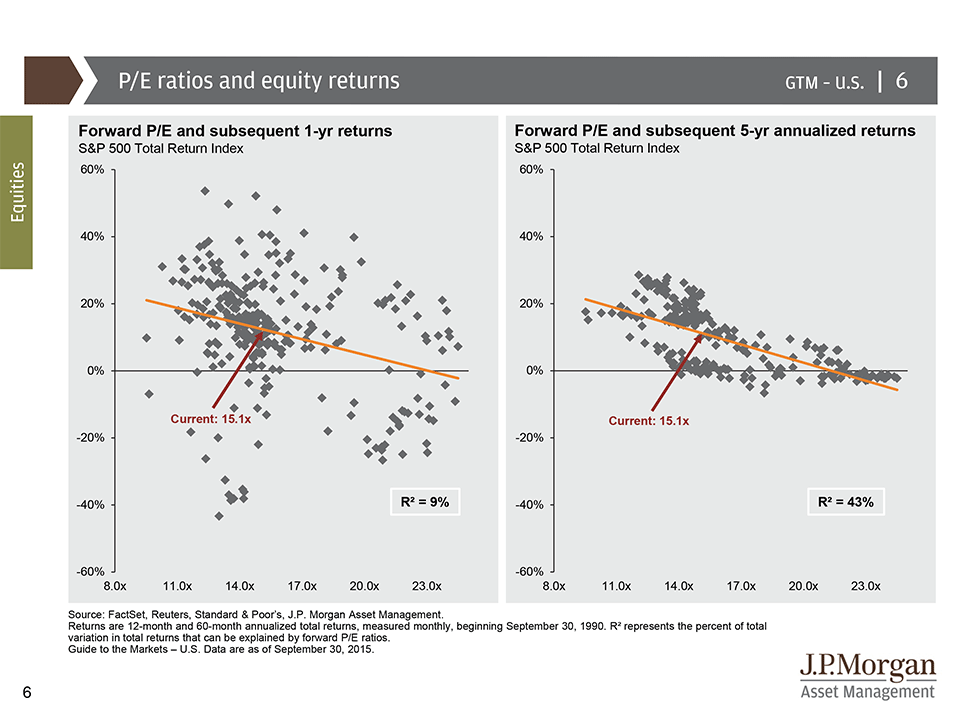

- P/E Ratio is a poor predictor of short term performance (1 years) and only “ok” at longer periods.

- Market Timing is difficult and rarely works

A quote from the article

“And the Final Reminder – While we try to look at markets rationally, they simply are not rationale in the short term. If investors start to panic and start selling equities and they witness this downturn, we certainly can see a much bigger drop. However, if the fundamentals stay strong, it should prove to be another bump in the road. Pullbacks similar to this are healthy for the market to remind investors that the stock market is risky.” August 24, 2015 blog entry

Mythical Bears and More Stock Market Reflections (Article from August 24, 2015)

This article was conceived because there are always good reasons to think bad things can happen. Sometimes, its driven by things that make sense other times, myths.

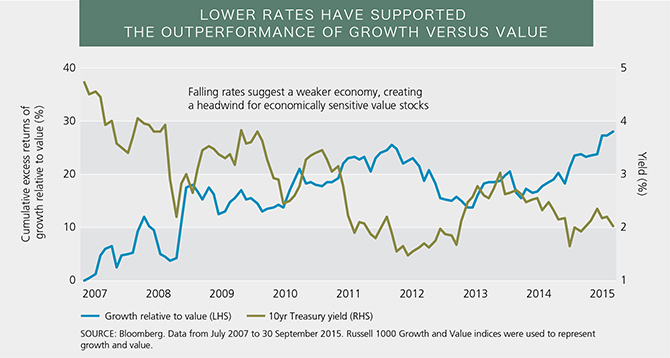

- Myth 1 – Market is going to drop because rates are going up

- Despite the logical myth, when the 10 year treasury bond is less than 5%, rate hikes are associated with a higher stock market (not a drop).

- This makes sense in that the Fed is shifting from an accommodating policy to a restrictive policy, they are unable to do so unless the economy is on firm footing which usually means a higher 10 year bond yield.

- Myth 2 – Companies are Fragile and poised to drop in value

- At this time, cash was at an all-time high and dividend payouts were increasing.

- Despite share buy backs and dividends increasing, cash was increasing on corporate balance sheets

- Myth 3 – Bull Market has run for 7 years and we are due for a major correction.

- Fact- 1946 to 1961 had 15 years between bear markets

- Fact – 1987 until the Tech bubble we had 13 years.

- Myth 4 – Markets Trend Up and Trend Down over intermediate and long time periods

- Over intermediate period (5-10 years) markets have generally trended up or flat vs downward trending.

- Marketing timing out of the market during a flat period offers minimal advantage vs staying in the market.

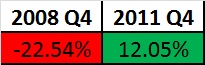

2015 Q3 Stock Market is it 2011 Q3 Again or 2008 Q3?

These articles compare similarities in 2011 and 2008’s Q3 at that point in time. This article’s point was to argue that 2011’s Q3 , looked as bad or even worth than 2008’s and yet had a favorable outcome. So while we can draw parallel’s to 2008 we also could look at 2011.

The Take Away

We will have stock market pull backs and we will have bear markets. It will be VERY difficult to tell the difference between the two and most times it will feel like a significant bear market is coming. At moments like these, it is important to understand that markets have risk and the risk of a pull back is real but we will have several false alarms before the real bear shows up. Unfortunately in most cases, we will need to participate in the bear market in order to not miss out on the long-term returns of the market.

Do I think we could have a pull back in the 10-15% range? Yes, I think its possible. Do I think we can see a bear market drop of greater than 20%? It is possible but less likely than a smaller drop. I do not see a drop like 2008 as that was a “once in a lifetime” drop, meaning it is the worst we have seen in our lifetime which means its unlikely to be that bad again (of course the possibility will always exist that we could see a worse drop).

** The information on this website is intended only for informational purposes. Reh Wealth Advisor clients should discuss with their advisor if any action is appropriate.

Most investors think of bonds as “safe”. The fact is bonds can be risky as well, not as risky as stocks generally speaking, but risky nonetheless.

Most investors think of bonds as “safe”. The fact is bonds can be risky as well, not as risky as stocks generally speaking, but risky nonetheless.