I am always finding myself looking up the Federal and California tax brackets so I thought I would add the info here for quick reference.

For your 2016 Federal & CA Tax Rates, Tax Tables, Personal Exemptions, and Standard Deductions | US Tax Center please click here for our updated article.

This post is fairly long and is one of my most popular pages. I made some Quick Links to make it easier to navigate to the section you want:

Federal Tax Rates, Tax Brackets, Personal Exemptions, Standard Deductions

2015 California Tax Rates, Tax Tables, Personal Exemptions and Standard Deductions

2015 Federal Tax Rates, Tax Tables, Personal Exemptions and Standard Deductions

This article gives you the tax rates and related numbers that you will need to prepare your 2015 income tax return. In general, 2015 individual tax returns are due by April 15, 2016.

Source: 2015 Federal Tax Rates, Personal Exemptions, and Standard Deductions | US Tax Center

Single:

| Taxable Income |

Tax Rate |

| $0 to $9,225 |

10% |

| $9,226 to $37,450 |

$922.50 plus 15% of the amount over $9,225 |

| $37,451 to $90,750 |

$5,156.25 plus 25% of the amount over $37,450 |

| $90,751 to $189,300 |

$18,481.25 plus 28% of the amount over $90,750 |

| $189,301 to $411,500 |

$46,075.25 plus 33% of the amount over $189,300 |

| $411,501 to $413,200 |

$119,401.25 plus 35% of the amount over $411,500 |

| $413,201 or more |

$119,996.25 plus 39.6% of the amount over $413,200 |

Married Filing Jointly or Qualifying Widow(er):

| Taxable Income |

Tax Rate |

| $0 to $18,450 |

10% |

| $18,451 to $74,900 |

$1,845.00 plus 15% of the amount over $18,450 |

| $74,901 to $151,200 |

$10,312.50 plus 25% of the amount over $74,900 |

| $151,201 to $230,450 |

$29,387.50 plus 28% of the amount over $151,200 |

| $230,451 to $411,500 |

$51,577.50 plus 33% of the amount over $230,450 |

| $411,501 to $464,850 |

$111,324.00 plus 35% of the amount over $411,500 |

| $464,851 or more |

$129,996.50 plus 39.6% of the amount over $464,850 |

Married Filing Separately:

| Taxable Income |

Tax Rate |

| $0 to $9,225 |

10% |

| $9,226 to $37,450 |

$922.50 plus 15% of the amount over $9,225 |

| $37,451 to $75,600 |

$5,156.25 plus 25% of the amount over $37,450 |

| $75,601 to $115,225 |

$14,693.75 plus 28% of the amount over $75,600 |

| $115,226 to $205,750 |

$25,788.75 plus 33% of the amount over $115,225 |

| $205,751 to $232,425 |

$55,662.00 plus 35% of the amount over $205,750 |

| $232,426 or more |

$64,998.25 plus 39.6% of the amount over $232,425 |

Head of Household:

| Taxable Income |

Tax Rate |

| $0 to $13,150 |

10% |

| $13,151 to $50,200 |

$1,315.00 plus 15% of the amount over $13,150 |

| $50,201 to $129,600 |

$6,872.50 plus 25% of the amount over $50,200 |

| $129,601 to $209,850 |

$26,772.50 plus 28% of the amount over $129,600 |

| $209,851 to $411,500 |

$49,192.50 plus 33% of the amount over $209,850 |

| $411,501 to $439,000 |

$115,737.00 plus 35% of the amount over $411,500 |

| $439,001 or more |

$125,362.00 plus 39.6% of the amount over $439,000 |

2015 Personal Exemption Amounts

You are allowed to claim one personal exemption for yourself and one for your spouse (if married). However, if somebody else can list you as a dependent on their tax return, you are not permitted to claim a personal exemption for yourself.

For tax year 2015, the personal exemption amount is $4,000 (up from $3,950 in 2014).

The personal exemption amount “phases out” for taxpayers with higher incomes. The Personal Exemption Phaseout (PEP) thresholds are as follows:

| Filing Status |

PEP Threshold Starts |

PEP Threshold Ends |

| Single |

$258,250 |

$380,750 |

| Married Filing Jointly |

$309,900 |

$432,400 |

| Married Filing Separately |

$154,950 |

$216,200 |

| Head of Hosuehold |

$284,050 |

$406,550 |

2015 Standard Deduction Amounts

There are two main types of tax deductions: the standard deduction and itemized deductions. You can claim one type of deduction on your tax return, but not both. For example, if you claim the standard deduction, you cannot itemize deductions – and vice versa (if you itemize deductions, you cannot claim the standard deduction). You are allowed to use whichever type of deduction results in the lowest tax.

The standard deduction is subtracted from your Adjusted Gross Income (AGI), thereby reducing your taxable income. For tax year 2015, the standard deduction amounts are as follows:

| Filing Status |

Standard Deduction |

| Single |

$6,300 |

| Married Filing Jointly |

$12,600 |

| Married Filing Separately |

$6,300 |

| Head of Household |

$9,250 |

| Qualifying Widow(er) |

$12,600 |

Please Note that Information Below these lines, refers to California Taxes, Rates, Deduction and the Information Above these lines and this Statement refers to Federal Taxes, Rates, Deductions, Etc.

2015 California Tax Rates, Tax Tables, Personal Exemptions and Standard Deductions

Source: https://www.ftb.ca.gov/forms/2015_California_Tax_Rates_and_Exemptions.shtml

Rate of inflation

The rate of inflation in California, for the period from July 1, 2014, through June 30, 2015, was 1.3%. The 2015 personal income tax brackets are indexed by this amount.

Corporate tax rates

| Entity type |

Tax rate |

| Corporations other than banks and financials |

8.84% |

| Banks and financials |

10.84% |

| Alternative Minimum Tax (AMT) rate |

6.65% |

| S corporation rate |

1.5% |

| S corporation bank and financial rate |

3.5% |

Individual tax rates

- The maximum rate for individuals is 12.3%

- The AMT rate for individuals is 7%

- The Mental Health Services Tax Rate is 1% for taxable income in excess of $1,000,000.

Exemption credits

| Filing Status/Qualification |

Exemption amount |

| Married/Registered Domestic Partner (RDP) filing jointly or qualifying widow(er) |

$218 |

| Single, married/RDP filing separately, or head of household |

$109 |

| Dependent |

$337 |

| Blind |

$109 |

| Age 65 or older |

$109 |

Phaseout of exemption credits

Higher-income taxpayers’ exemption credits are reduced as follows:

| Filing status |

Reduce each credit by: |

For each: |

Federal AGI exceeds: |

| Single |

$6 |

$2,500 |

$178,706 |

| Married/RDP filing separately |

$6 |

$1,250 |

$178,706 |

| Head of household |

$6 |

$2,500 |

$268,063 |

| Married/RDP filing jointly |

$12 |

$2,500 |

$357,417 |

| Qualifying widow(er) |

$12 |

$2,500 |

$357,417 |

When applying the phaseout amount, apply the $6/$12 amount to each exemption credit, but do not reduce the credit below zero. If a personal exemption credit is less than the phaseout amount, do not apply the excess against a dependent exemption credit.

Standard deductions

The standard deduction amounts for:

| Filing status |

Deduction amount |

| Single or married/RDP filing separately |

$4,044 |

| Married/RDP filing jointly, head of household, or qualifying widow(er) |

$8,088 |

| The minimum standard deduction for dependents |

$1,050 |

Reduction in itemized deductions

Itemized deductions must be reduced by the lesser of 6% of the excess of the taxpayer’s federal AGI over the threshold amount or 80% of the amount of itemized deductions otherwise allowed for the taxable year.

| Filing status |

AGI threshold |

| Single or married/RDP filing separately |

$178,706 |

| Head of household |

$268,063 |

| Married/RDP filing jointly or qualifying widow(er) |

$357,417 |

Nonrefundable Renter’s credit

This nonrefundable, non-carryover credit for renters is available for:

- Single or married/RDP filing separately with a California AGI of $38,259 or less.

- Married/RDP filing jointly, head of household, or qualifying widow(er) with a California AGI of $76,518 or less.

Miscellaneous credits

- Qualified senior head of household credit

- 2% of California taxable income

- Maximum California AGI of $69,902

- Maximum credit of $1,317

- Joint custody head of household credit/dependent parent credit

- 30% of net tax

- Maximum credit of $431

AMT exemption

| Filing status |

Amount |

| Married/RDP filing jointly or qualifying widow(er) |

$87,627 |

| Single or head of household |

$65,721 |

| Married/RDP filing separately, estates, or trusts |

$43,812 |

AMT exemption phaseout

| Filing status |

Amount |

| Married/RDP filing jointly or qualifying widow(er) |

$328,601 |

| Single or head of household |

$246,451 |

| Married/RDP filing separately, estates, or trusts |

$164,299 |

FTB cost recovery fees

| Fee type |

Fee |

| Bank and corporation filing enforcement fee |

$92 |

| Bank and corporation collection fee |

$334 |

| Personal income tax filing enforcement fee |

$79 |

| Personal income tax collection fee |

$226 |

The personal income tax fees apply to individuals and partnerships, as well as limited liability companies that are classified as partnerships. The bank and corporation fees apply to banks and corporations, as well as limited liability companies that are classified as corporations. Interest does not accrue on these cost recovery fees.

2015 California Tax Rate Schedules

Schedule X — Single or married/RDP filing separately

| If the taxable income is |

| Over |

But not over |

Tax is |

Of amount over |

| $0 |

$7,850 |

$0.00 |

plus |

1.00% |

$0 |

| $7,850 |

$18,610 |

$78.50 |

plus |

2.00% |

$7,850 |

| $18,610 |

$29,372 |

$293.70 |

plus |

4.00% |

$18,610 |

| $29,372 |

$40,773 |

$724.18 |

plus |

6.00% |

$29,372 |

| $40,773 |

$51,530 |

$1,408.24 |

plus |

8.00% |

$40,773 |

| $51,530 |

$263,222 |

$2,268.80 |

plus |

9.30% |

$51,530 |

| $263,222 |

$315,866 |

$21,956.16 |

plus |

10.30% |

$263,222 |

| $315,866 |

$526,443 |

$27,378.49 |

plus |

11.30% |

$315,866 |

| $526,443 |

AND OVER |

$51,173.69 |

plus |

12.30% |

$526,443 |

Schedule Y — Married/RDP filing jointly, or qualifying widow(er) with dependent child

| If the taxable income is |

| Over |

But not over |

Tax is |

Of amount over |

| $0 |

$15,700 |

$0.00 |

plus |

1.00% |

$0 |

| $15,700 |

$37,220 |

$157.00 |

plus |

2.00% |

$15,700 |

| $37,220 |

$58,744 |

$587.40 |

plus |

4.00% |

$37,220 |

| $58,744 |

$81,546 |

$1,448.36 |

plus |

6.00% |

$58,744 |

| $81,546 |

$103,060 |

$2,816.48 |

plus |

8.00% |

$81,546 |

| $103,060 |

$526,444 |

$4,537.60 |

plus |

9.30% |

$103,060 |

| $526,444 |

$631,732 |

$43,912.31 |

plus |

10.30% |

$526,444 |

| $631,732 |

$1,052,886 |

$54,756.97 |

plus |

11.30% |

$631,732 |

| $1,052,886 |

AND OVER |

$102,347.37 |

plus |

12.30% |

$1,052,886 |

Schedule Z — Head of household

| If the taxable income is |

| Over |

But not over |

Tax is |

Of amount over |

| $0 |

$15,710 |

$0.00 |

plus |

1.00% |

$0 |

| $15,710 |

$37,221 |

$157.10 |

plus |

2.00% |

$15,710 |

| $37,221 |

$47,982 |

$587.32 |

plus |

4.00% |

$37,221 |

| $47,982 |

$59,383 |

$1,017.76 |

plus |

6.00% |

$47,982 |

| $59,383 |

$70,142 |

$1,701.82 |

plus |

8.00% |

$59,383 |

| $70,142 |

$357,981 |

$2,562.54 |

plus |

9.30% |

$70,142 |

| $357,981 |

$429,578 |

$29,331.57 |

plus |

10.30% |

$357,981 |

| $429,578 |

$715,962 |

$36,706.06 |

plus |

11.30% |

$429,578 |

| $715,962 |

AND OVER |

$69,067.45 |

plus |

12.30% |

$715,962 |

Individual Filing Requirements

If your gross income or adjusted gross income is more than the amount shown in the chart below for your filing status, age, and number of dependents, then you have a filing requirement.

| Filing Status |

Age as of December 31, 2015* |

California Gross Income |

California Adjusted Gross Income |

| Dependents |

Dependents |

| 0 |

1 |

2 or more |

0 |

1 |

2 or more |

| Single or head of household |

Under 65 |

$16,256 |

$27,489 |

$35,914 |

$13,005 |

$24,238 |

$32,663 |

| 65 or older |

$21,706 |

$30,131 |

$36,871 |

$18,455 |

$26,880 |

$33,620 |

| Married/RDP filing jointly or separately |

Under 65 (both spouses/RDPs) |

$32,514 |

$43,747 |

$52,172 |

$26,012 |

$37,245 |

$45,670 |

| 65 or older (one spouse) |

$37,964 |

$46,389 |

$53,129 |

$31,462 |

$39,887 |

$46,627 |

65 or older

(both spouses/RDPs) |

$43,414 |

$51,839 |

$58,579 |

$36,912 |

$45,337 |

$52,077 |

| Qualifying widow(er) |

Under 65 |

N/A |

$27,489 |

$35,914 |

N/A |

$24,238 |

$32,663 |

| 65 or older |

N/A |

$30,131 |

$36,871 |

N/A |

$26,880 |

$33,620 |

| Dependent of another person (Any filing status) |

Under 65 |

More than your standard deduction |

| 65 or older |

More than your standard deduction |

* If you turn 65 on January 1, 2016, you are considered to be age 65 at the end of 2015.

PLEASE NOTE THAT I HAVE COMPILED THIS INFORMATION FOR AN EASY PLACE TO LOOK UP AND REFER TO THE DATA. I BELIEVE IT ALL TO BE CORRECT BUT I AM NOT RESPONSIBLE FOR ANY TYPOS. THIS PAGE IS FOR INFORMATIONAL PURPOSES, PLEASE SPEAK WITH YOUR TAX EXPERT/PREPARER WHEN MAKING TAX DECISIONS. THIS PAGE SHOULD NOT BE CONSIDERED TAX ADVICE.

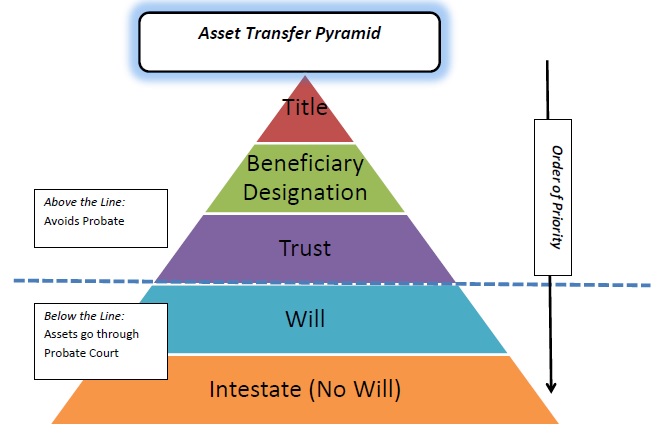

ies of life insurance and retirement accounts, it is usually a bad idea to do so. A minor beneficiary cannot inherit, so a court Guardianship proceeding will generally be required. This is both expensive and inconvenient. In addition, guardianship courts do not have power to continue to control the asset once the minor reaches adulthood. Thus, the child will receive the inheritance in full, no strings attached, at 18. If you have minor beneficiaries, and you wish to avoid guardianship, you should consider creating an trust to hold these assets after your death. You can name who you wish to be in charge of the assets and set forth the purposes the assets can be utilized for.

ies of life insurance and retirement accounts, it is usually a bad idea to do so. A minor beneficiary cannot inherit, so a court Guardianship proceeding will generally be required. This is both expensive and inconvenient. In addition, guardianship courts do not have power to continue to control the asset once the minor reaches adulthood. Thus, the child will receive the inheritance in full, no strings attached, at 18. If you have minor beneficiaries, and you wish to avoid guardianship, you should consider creating an trust to hold these assets after your death. You can name who you wish to be in charge of the assets and set forth the purposes the assets can be utilized for.