Asset Transfer Pyramid – Estate Planning Explained

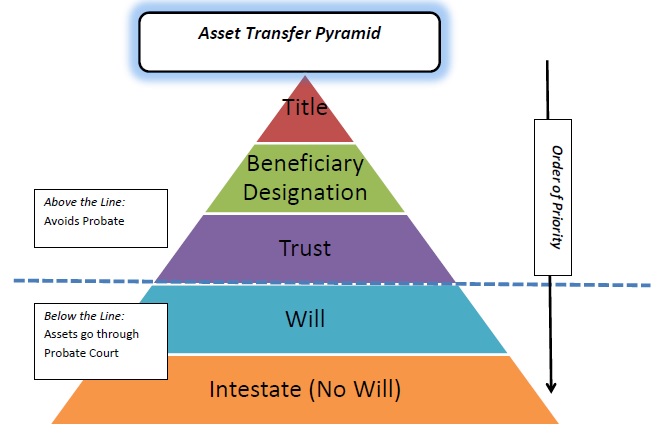

One of first keys to Estate Planning is understanding how assets transfer. The “Asset Transfer Pyramid” provides are great visual aid. The top of the pyramid takes priority. If an asset transfers by any step above, it will ignore the layers below it on the pyramid. Therefore, to check how an asset transfers you:

- First check if the asset transfers by title

- Then check the beneficiary designation (if it has one)

- If owned by a trust, the asset can pass via the trust document. In order for an asset to pass via trust, it must not pass via title or beneficiary designation. A trust can be the owner via title and the trust can be named a beneficiary.

- If the asset does not pass by Title, Beneficiary Designation or Trust, the asset will likely pass through probate (below the dotted line). Probate is a legal process in court that identifies and distributes a person’s property.

- If there is a will, the probate court will enforce the wishes of the will.

- If there is no will (called intestate), it will pass according to state law.

By using these rules, you can craft an estate plan that will help you achieve your goals.

Jennifer L Field is an attorney in Claremont and an expert in Estate Planning. I have asked her to help answer some common questions she sees with titles and estate planning.

Common Asset Transfer Problems by Jennifer L. Field

- Not doing anything – The most common mistake in asset titling is not making any arrangements with the financial institution regarding what will happen at your death. If your asset is 1) not held in trust, 2) doesn’t have a joint tenant, and 3) doesn’t have a named beneficiary, that asset will be subject to probate when you die. That means 1) the asset won’t be available to your heirs for a minimum of 40 days, 2) your heirs may require a full probate proceeding to access the asset, and 3) the asset may not be distributed as you wish. There are some circumstances in which leaving an asset titled in your name alone is a valid estate planning decision. However, the consequences of doing so should always be examined before making that decision.

- Holding property in one spouse’s name only – Most married couples hold most of their community property assets in joint tenancy. Joint tenancy implies an automatic right of survivorship. That means when the first spouse dies, the asset will go to the surviving spouse as a matter of law. (Although there may be a little paperwork needed to formalize the transfer.) But some married individuals hold assets in their names alone. Sometimes this done intentionally, often it is not. If the consequences of doing so are not considered, holding property in this manner can result in a court probate proceeding and assets being transferred to individuals other than the surviving spouse, such as children (including minor children, which creates another area of problems) and other relatives.

- Not understanding which document will control – Many people assume that if they have a will or a trust, every asset will be governed by that document. That is not the case. For example, properties held in joint tenancy will go to the surviving joint tenant(s) and accounts with named beneficiaries will go to those beneficiaries. This will be true even if the result conflicts with the terms of your trust or will. Only assets titled in the name of the trust will go pursuant to the trust instrument. Assets that don’t fall into any of these categories will go pursuant to your will, or if there is none, according to state law. It is important to carefully consider where you want each asset to go on your death and make sure that your estate plan will produce that result.

- Not updating designations/document after major events – Events such as births, deaths, marriages, divorces, changing medical conditions, changing residence locations, and changing relationships all may potentially result in a change being made to one or more estate planning document. Any time one of these events occurs, it is important to review your estate plan in light of that change and consider whether you should make any changes to your provisions.

- Naming minors as beneficiaries – Although it is fairly common to name minor children as direct beneficiar

ies of life insurance and retirement accounts, it is usually a bad idea to do so. A minor beneficiary cannot inherit, so a court Guardianship proceeding will generally be required. This is both expensive and inconvenient. In addition, guardianship courts do not have power to continue to control the asset once the minor reaches adulthood. Thus, the child will receive the inheritance in full, no strings attached, at 18. If you have minor beneficiaries, and you wish to avoid guardianship, you should consider creating an trust to hold these assets after your death. You can name who you wish to be in charge of the assets and set forth the purposes the assets can be utilized for.

ies of life insurance and retirement accounts, it is usually a bad idea to do so. A minor beneficiary cannot inherit, so a court Guardianship proceeding will generally be required. This is both expensive and inconvenient. In addition, guardianship courts do not have power to continue to control the asset once the minor reaches adulthood. Thus, the child will receive the inheritance in full, no strings attached, at 18. If you have minor beneficiaries, and you wish to avoid guardianship, you should consider creating an trust to hold these assets after your death. You can name who you wish to be in charge of the assets and set forth the purposes the assets can be utilized for. - Not funding your trust – Some people believe that merely creating a trust is sufficient to avoid probate. No so. In order for an asset to be part of a trust, title to that asset must be transferred to the trust. Simply discussing the asset in the trust or listing it on a schedule of assets will not transfer title. You must actually make the trust the owner of that asset. For real property, a deed must be recorded. For accounts at financial institutions, you must change title with the institution itself. Only then will the asset truly be owned by the trust. Likewise, keep in mind that pour-over wills that leave your estate to your trust do not avoid probate. They simply direct your assets to the trust in the event that probate is necessary because title wasn’t transferred during your lifetime. Check out the article on Retirewire on: Living Trusts – common problem solved! Please fund your trust

- Using joint tenancy as an estate planning device – It is generally a bad idea to try to take an estate planning shortcut by adding a beneficiary to an asset as a joint tenant to avoid probate. Doing so creates an irrevocable gift to that beneficiary and establishes the beneficiary as a current owner of the asset. This results the asset being subject to the beneficiary’s creditors and many other major unintended consequences. Generally speaking, a trust is the more prudent way to avoid probate.

- Not considering retirement accounts – Careful thought must be given as to how tax deferred assets should be planned for. They should not be transferred to a trust during lifetime. Instead, beneficiary designations should be used to avoid probate. It is possible to name a trust as the beneficiary, but the consequences of doing so should be discussed with your attorney as it may result in unintended tax consequences.

Thank you for the opportunity to address these common issues. Please feel free to contact me regarding any estate planning questions you may have.

Law Office of Jennifer L. Field

405 N. Indian Hill Boulevard

Claremont, CA 91711

(909) 625-0220

jfield@jlfieldlaw.com

www.jlfieldlaw.com

Thank you Jennifer for contributing your expertise to this article. I hope you found our Asset Transfer Pyramid and Jennifer’s Comments Helpful!

UPDATE 10/6/2016 – Check out the article I wrote for Retirewire discussing a similar topic

Living Trusts – common problem solved! Please fund your trust

UPDATE 3/14/2017 – Check out the article on Retirewire where I help explain a Potential Estate Planning Issue with Power of Attorneys.

** The information in this article is intended only for informational purposes. Investors should not act upon any of the information here. Reh Wealth Advisor clients should discuss with their advisor if any action is appropriate.

Confusion Image Courtesy of Stuart Miles at FreeDigitalPhotos.net

Child with money Image Courtesy of David Castillo Dominici at FreeDigitalPhotos.net