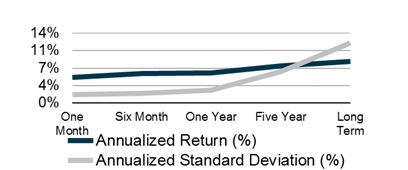

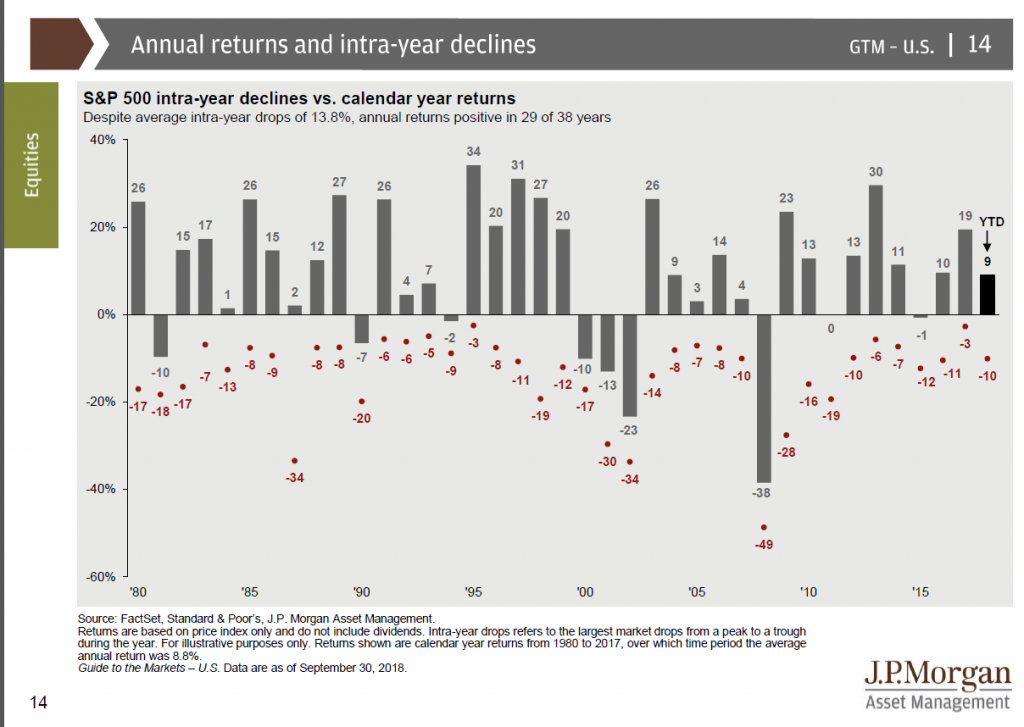

The S&P500 has now officially dropped 20% from its market high. It has exceeded the 14% on average drop. Its now officially a correction. I have said multiples times over the past 10 years that most pullbacks are temporary and we should not try to time the stock market. That has proved wise as we experienced a 16% drop in 2010, a 19% drop in 2011, a 10% drop in 2012, 12% drop in 2015, 11% drop in 2016. Each of those times, we were better off assuming things would not get worse.

Last September/October when I wrote that we need to be patient as the drop in the market could be a false alarm as it was the previous times. This time was indeed different and the market dropped quickly in December of 2018. So now, what do we do?

Source: https://am.jpmorgan.com/us/en/asset-management/gim/adv/insights/guide-to-the-markets

Too Late Market is ALREADY predicting a minor recession

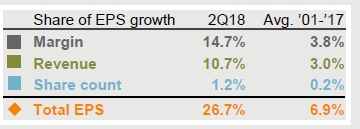

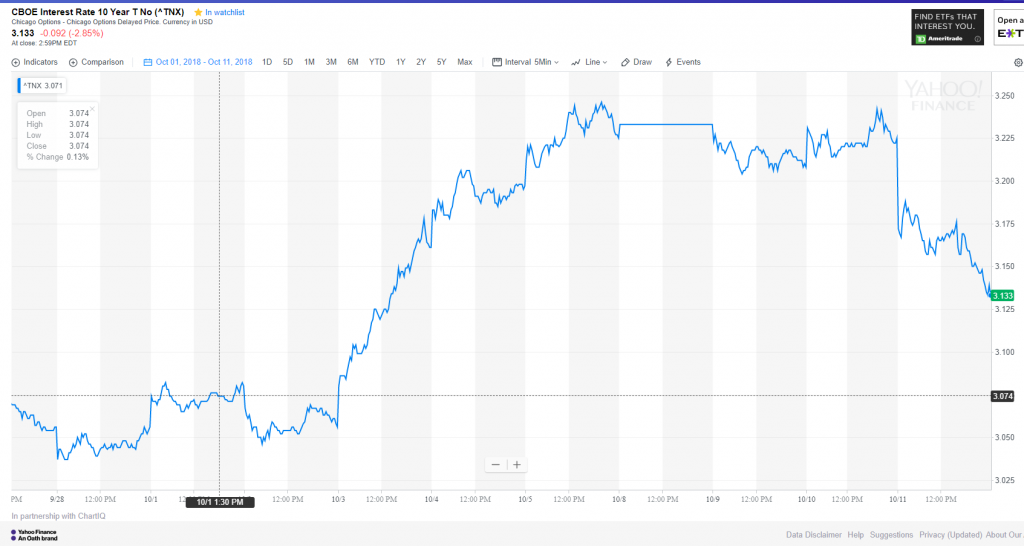

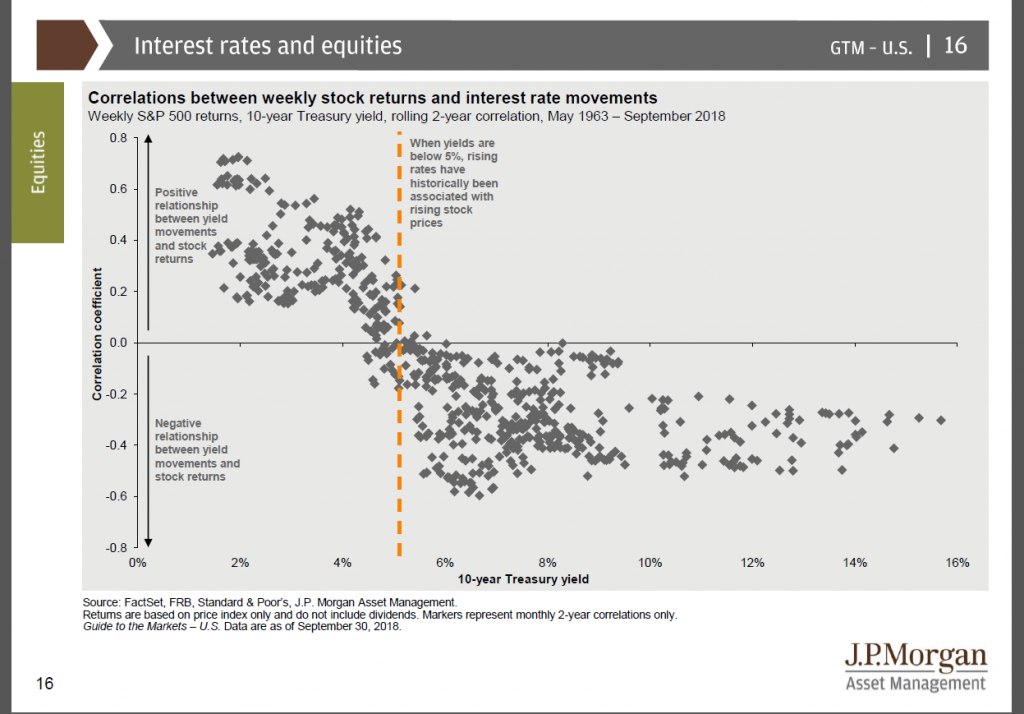

The stock market is a LEADING indicator for the economy. The economy currently as of today, is still showing strength. Unemployment is low and earnings are up. Why is the market dropping then? Future expectations is the answer. With rising interest rates from an aggressive Fed, “the market” is predicting that the economy will worsen and earnings will drop and unemployment will get worse.

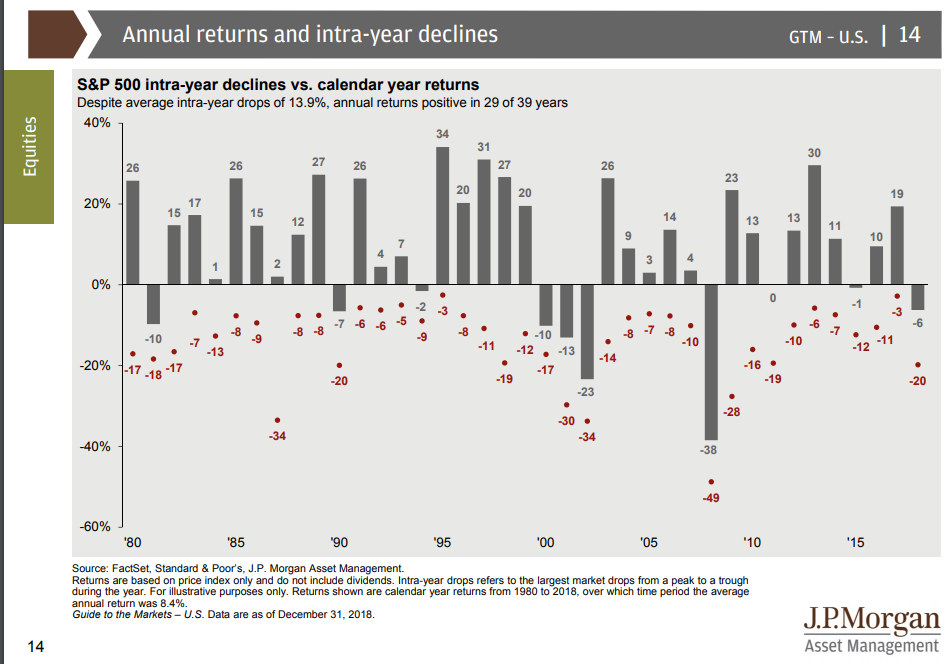

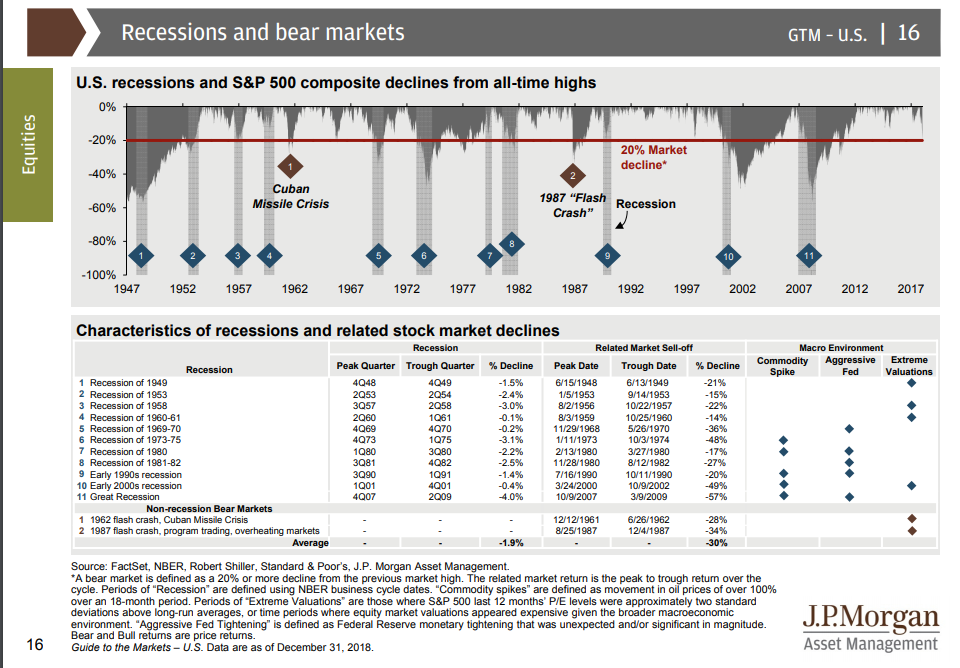

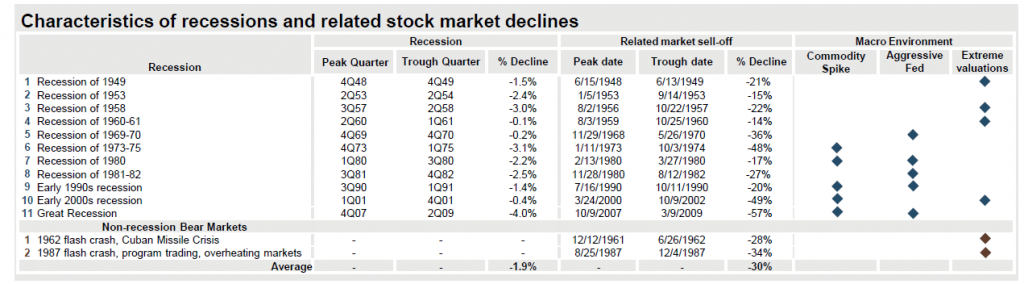

Previous Recessions / Bear Markets

Source: https://am.jpmorgan.com/us/en/asset-management/gim/adv/insights/guide-to-the-markets

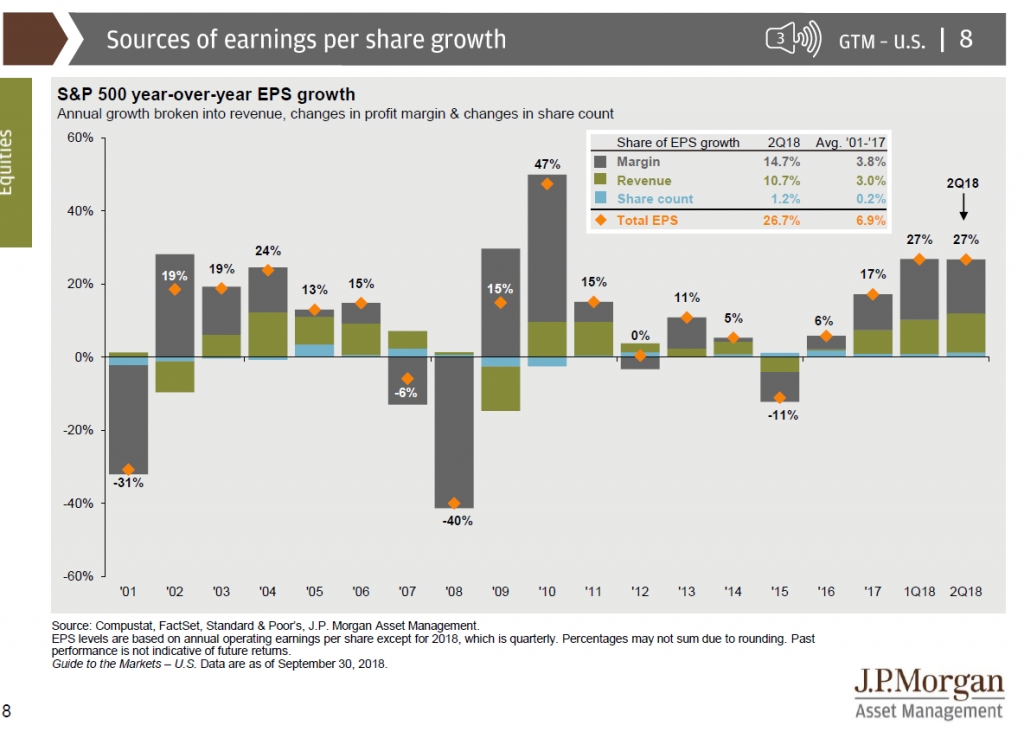

As you can see from the chart above, there are some examples where the markets sold off even more than what we have seen.

Great Recession of 2008- a 57% drop

Early 2000s (dot com bubble bursting) – 49% drop

Recession of 1973 – 48% drop

Recession of 1969 – 36% drop

We also had a couple of non-recession bear market drops of 28% and 34%.

Realistically, I think the Great Recession and the Dot Com bubble bursting were two historic events that are likely outliers. Which means if we use history as our guide, we are at a 20% drop and may have some room to drop further but we have likely already seen the worst of it. Is it possible it drops another 30%? Yes but I feel its less likely that being less than 10%.

Market Could Recover at any moment but the longest it should take until the drop stops within 1-2 years of starting

The market hit its most recent high as of August 29th 2018. If we look at the previous chart, most drops end within a year and nearly all within 2 years (dot com bubble lasted a little longer). We are already 3-4 months into this drop. The market could recovery at any moment and return to positive returns. The valuations currently look better than they have for years.

For those arguing that “I don’t have time to make up if it drops more”, even if it lasts on the long side at 2 years, you still are not drawing the majority of your portfolio within the next 2 years. You can wait this out and you will likely be better off for it as when you exit the market, then you will be faced with a tough decision of when do you re-enter. Its important to understand the reversal can come at ANYTIME within 2 years. It could have already started the recovery and we don’t know it yet. When markets reverse from a downturn, they often reverse VERY quickly and experience the largest gains in the beginning when many doubt whether the recovery is real.

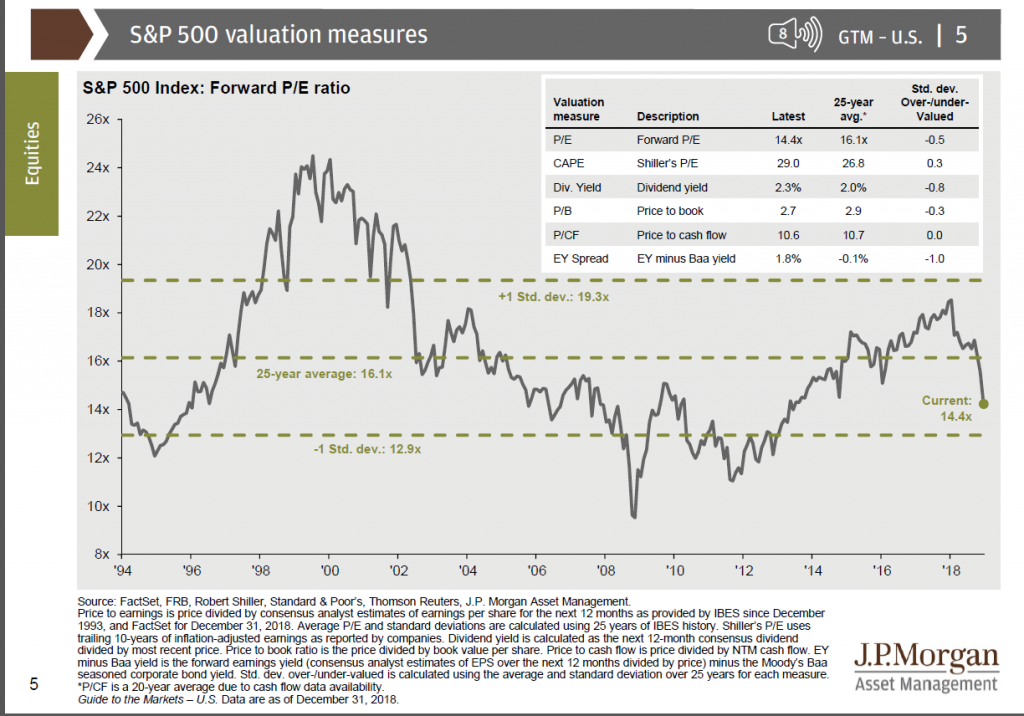

Where are Valuations Now?

Looking at the above chart from JP Morgan we can see the past 25 years this market drop has made several measures report that the market is now undervalued. Foreward P/E, Dividend Yield, Price to Book, and earnings yield less Baa bond yield all show a market that is undervalued relative to the 25 year average. The only metric showing the market might be slightly overvalued is the Shiller P/E ratio which uses 10 years of earnings data so its tells us less about where we are now and more about how the past decade compares.

On the whole, I feel better about the valuations of the market than I have in a long time. Bear in mind, these numbers indicate that either 1) market will go up or 2) that a recession is coming and fundamentals will deteriorate relative to prices.

What do we do?

I hate to say nothing but the most prudent action is to review our risk allocations and make sure our portfolios still meets our investment objectives. Valuations look very attractive currently and I do think the outlook for the market is better than it was 1 year ago. It may sound odd but the 20% drop is HEALTHY for the stock market. It reminds investors there is risk that goes with reward.

The market has survived much worse times than the ones we are facing now and it will survive this one as well. The most difficult and critical component to success will be sticking with a long term investment plan and not letting market corrections derail the success of your plan.

I will continue to work hard for you to help you reach your goals and perform actions that are supported by research to help you continue to make good decisions with your finances.

Most investors think of bonds as “safe”. The fact is bonds can be risky as well, not as risky as stocks generally speaking, but risky nonetheless.

Most investors think of bonds as “safe”. The fact is bonds can be risky as well, not as risky as stocks generally speaking, but risky nonetheless.