2015 Q3 Stock Market, Is it 2011 Q3 Again or 2008 Q3?

UPDATE – 1/20/2015 – We posted an article with the results of the 2015Q4 here:

2015 Q4 Update 2015 Q3 is it 2011 again or 2008?

If this past quarter’s stock market performance sounds familiar, it’s because it is. We have experienced a similar market performance as we did in the 3rd quarter of 2008 and the 3rd quarter of 2011.

POP QUIZ – Which quarter had worse performance, 2008 Q3 or 2011 Q3?

Answer: 2011 Q3 losing 14.92% vs 2008 Q3 losing 8.87% using Morningstar’s Total US Market Index.

Our memory of that ugly 2008 year likely led you to believe Q3 2008 was worse but we actually had worse returns in 2011.

In 2011, we heard story after story about how were were entering into a recession and that investors and how the market was just starting its tumble. What were the headlines in 2011?

- Sovereign debt crisis in particular Greece was first and foremost on the news cycle

- Bond Bubble’s were prominent headlines and fears of the Fed Raising Rates

- Media Commentators were comparing the bankruptcies of Lehman Brothers and Bear Sterns during the financial crisis and to Greece, Portugal, Spain, and Ireland and trying to correctly predict a huge market correction.

- It was difficult at that time to find good financial news anywhere.

What did we say at the time? Quoting our Quarterly Commentary in Q3 2011 appears appropriate to review:

Recession Looming?

The truth? No one really knows where the economy is headed. The stock market is currently pricing in a slowing of the economy and uncertainty in Europe. If the fear causes consumers to pull back their spending, we could quickly see another recession.

In 1975, the temptation of market timing was as prevalent as is it is today. William Sharpe performed statistical analysis of how often a person would have to be correct in order to make money through market timing. Through statistical analysis, Sharpe demonstrated an investor that can be 100% stocks or 100% cash would have to be correct over 74% of the time to make more money than buy and hold.

Furthermore, Morningstar looked at mutual fund inflows and outflows to determine how effective investors were at timing their purchases. In US Equities, the average investor earned 0.22% while the average fund over that time period earned 1.59% (http://news.morningstar.com/articlenet/article.aspx?id=325664

). This data shows that investors typically are poor market timers and tend to “sell low” and “buy high”.

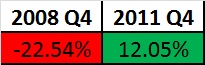

What Happened in Q4 2011 and Q4 2008?

Q4 2008, would go on to become one of the worst on record while 2011 Q4 would snap back and for the year, 2011 would be in the green.

What is the lesson here? After a drop like we have experienced this past quarter, its important to recognize that both outcomes can occur. The market can get worse or it can get better. Further, it will likely get better or worse more quickly than we can realize or react to. These two moments in our history show how difficult it can be to time the market.

Any Similarities Now to Q3 2008 or Q3 2011?

Right now the stories seem to dominate:

- International Economic Weakness (similar to 2011).

- Bond Market Fears (similar to 2011)

- Recession Fears (similar to both 2008 and 2011).

2008 Q3 was most focussed on sub prime mortgages and if that was the extent of our financial crisis. As we would find out in Q4, the financial crisis extended beyond sub prime mortgages and took the entire economy with it.

2008 was one of the worst years in the history of the stock market and historically is an anomaly. While 2011’s Q3 was a bad quarter, 2011 more of a normal stock market year and ended slightly positive.

I am hopeful that 2015 will be similar to 2011 or at least the 4th quarter being more stable that 2008. I am fearful that the “animal spirits” and unpredictable nature of the stock market could create another 4th quarter similar to 2008 (although in my opinion, it is unlikely).

I am going to leave you with a quote from our 2011 Q3 Commentary which I think is appropriate now:

Outlook

Relying on our asset allocation models will help us from letting fear or greed lead us to poor financial decisions. It’s easy to forget that previous times in history have had just as many uncertainties as we face today. We will end this quarter’s commentary with a reflection on decade’s past challenges:

- 1910’s – World War 1

- 1920’s – Rampant Organized Crime (They were so organized they actually had a national convention in Cleveland Ohio December 5th 1928)

- 1930’s – Great Depression

- 1940’s – World War 2

- 1950’s – McCarthyism and the fear of America being infiltrated by communists

- 1960’s – Vietnam and the Bay of Pigs

- 1970’s – Watergate Scandal, Stagflation, Oil Crisis

- 1980’s – Mexican Debt Crisis, Chernobyl Nuclear Reactor Leak

- 1990’s – Gulf War, Oklahoma City Bombing, World Trade Center Bombing

- 2000’s – 9/11 World Trade Center Attack, Dot Com Bubble Bursting, Housing Bubble and Burst

Further relevant reading from our other article about the current market you might find interesting are:

https://investwithsteve.com/2015/08/stock-market-pull-back-time-to-reflect/

https://investwithsteve.com/2015/09/mythical-bears-and-more-stock-market-reflections/

UPDATE – 1/20/2015 – We posted an article with the results of the 2015Q4 here:

2015 Q4 Update 2015 Q3 is it 2011 again or 2008?

** The information on this website is intended only for informational purposes. Investors should not act upon any of the information here without performing their own due diligence. Reh Wealth Advisor clients should discuss with their advisor if any action is appropriate.