The corona virus continues to dominate the financial press and has resulted in one of the fastest 10% drops in the stock market that we have seen. While its been fast and furious, I think its important to remember that throughout history the patient investor has been rewarded for taking risk and staying in the market.

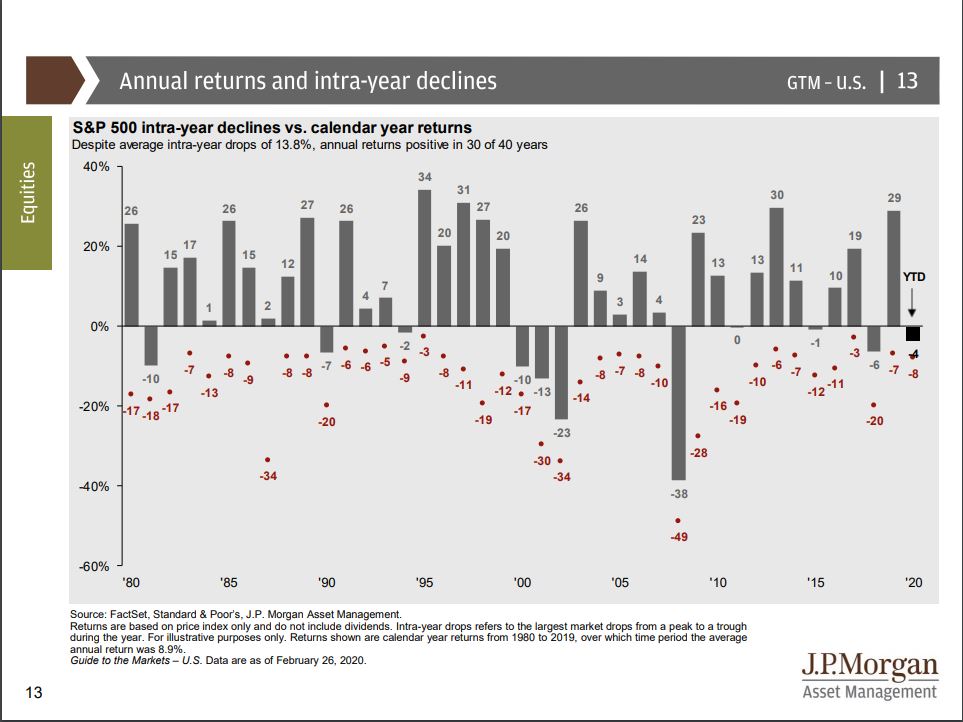

The Average Drop in any given year from the market high is 13.8%

As the chart above shows, in any given year we see an average drop of 13.8% from the market high. Even with the recent 10% drop the S&P500 quickly saw. We still have not gone beyond a “normal” stock market pull back. While it can be difficult its important to remember the patient investor is rewarded.

While less common, we can see market corrections of 20% like we saw near the end of 2018. Investors that were patient and stayed invested, enjoyed a great 2019.

It has Always been a bumpy ride even when hindsight feels smooth

The past run since 2008 has survived:

- Muni Bond “Crisis” – some analysts were calling for massive losses in the municipal bond market and that it would not only hurt the bond market but would hurt equities. Neither the bond market or stock market sufferred and its been a long time since we have heard concerns about massive amounts of muni bond defaults.

- Greece’s Economic Mess would take down Europe and the US would follow – The market dropped in 2011 but it was short lived and the market continued its climb

- War on terrorism

- Previous Epidemic Scares

- Swine Flu in 2009

- Cholera in 2010

- MERS in 2013

- Ebola in 2014

- Measles/Rubeola End of 2014 Early 2015

- Zika Virus at Olympics in 2016

- Measles/Rebeola 2019

Previous Epidemics have had minimal long term impacts on the Market

You can read the article I wrote a few days ago which discusses the previous impacts of epidemics here:

Doing the “Right” thing feels a little wrong

There is a temptation to “do something” despite research showing us that time and time again, the best advice is to persevere through market pull backs and corrections. Trying to time the market is paved with people that have failed attempting to do so. Here is a quick reminder of the rewards of sticking to our model and long term plan:

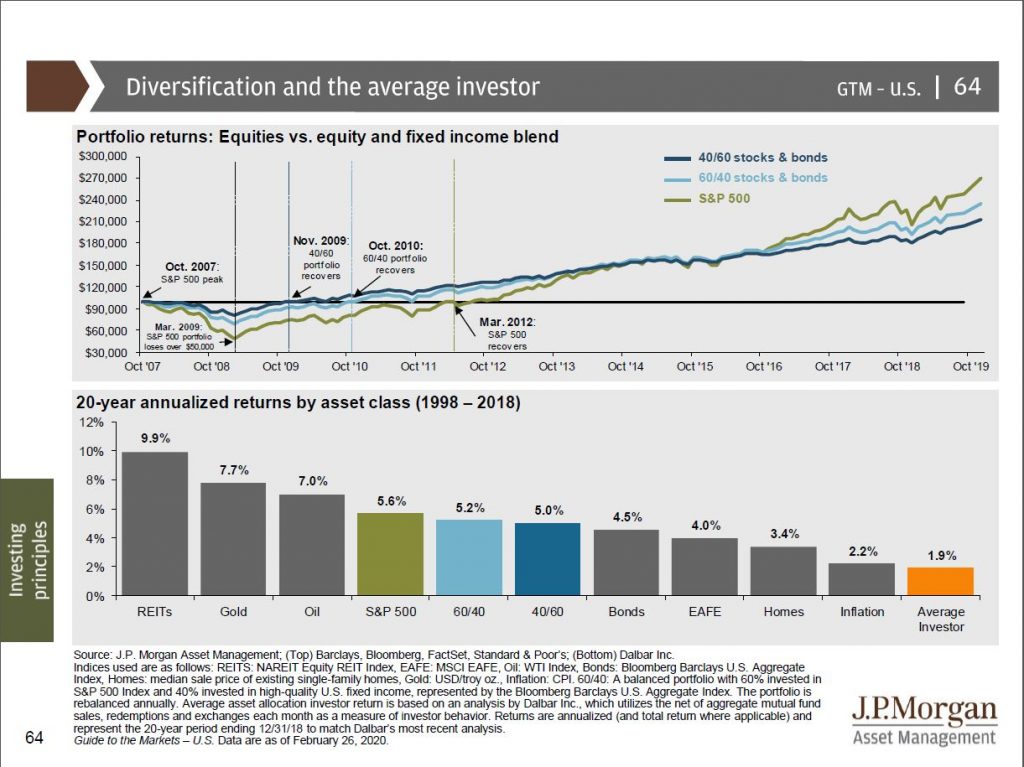

This chart from JP Morgan shows us a few things. The Average investor under performs nearly any asset class over the past 20 years. The only way the average investor can under perform nearly every investment is by market timing or by jumping from one fad to the next. Had the investor stuck with a 60/40 portfolio they would have earned over 3% higher returns. Bear in mind the past 20 years from 1998 to 2018 are starting at nearly the peak of the dot com bubble. So the returns are inclusive of both the dot com bubble bursting and the financial crisis.

The next thing to remember is that 2008 was the worst stock market of our lifetimes. However, the recovery came swift and a return to value

- 40% stocks/60% bond portfolio recovering by November 2009

- 60% stocks / 40% bond portfolio recovering fully by October 2010

- The 100% stock S&P500 recovered full by March 2012

A Reminder not to let short term results impact your long term plan

Its often easy to say that we should invest for the long term and stick to our plan. However, once we are in the middle of a market correction, it can be challenging. Here is a reminder of the article I sent the last time the market dropped 20% in 2018 before having a great 2019:

Clients should not hesitate reaching out to me to schedule a meeting or call. I am here and working on helping you reach your financial goals.

** The information on this website is intended only for informational purposes. Reh Wealth Advisor clients should discuss with their advisor if any action is appropriate.